The recent crisis in American regional banks has shaken the financial sector, leaving many investors uncertain about the future of banking institutions. However, it’s important to note that not all banks are affected in the same way, and there are opportunities to be seized even in a challenging environment. This is particularly true for Financial Institutions Inc (FISI), whose stock has experienced a significant decline due to the crisis. In this article, we will explore why investing in Financial Institutions Inc could be a wise decision by capitalizing on this situation.

Analysis of the Current Stock Price:

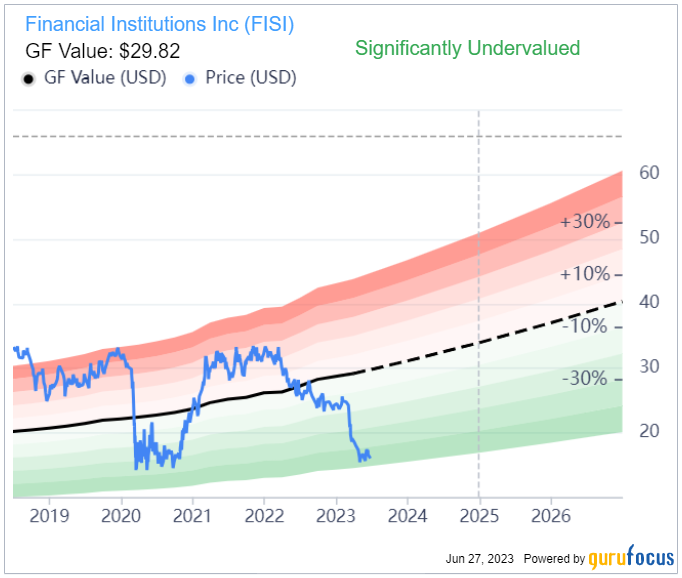

Currently trading at $16.10, Financial Institutions Inc’s stock price is considerably below its estimated intrinsic value of $29.82 as per Gurufocus. This undervaluation can be partially attributed to the widespread mistrust towards the banking sector due to the recent failures of American regional banks. However, it’s important not to confuse Financial Institutions Inc with these troubled institutions. Financial Institutions Inc has maintained a strong management and has not been directly affected by recent events.

Strong Financial Position:

Financial Institutions Inc stands out for its solid financial position and resilience in the face of market turbulence. As an established regional bank, it has demonstrated prudent management and has avoided excessive risks that led to the failure of certain institutions. Financial Institutions Inc’s financial fundamentals remain strong, with stable earnings and consistent revenue growth in recent years.

Investment Opportunity:

The decline in Financial Institutions Inc’s stock price presents an interesting opportunity for investors seeking undervalued stocks. By purchasing shares of Financial Institutions Inc at a price below their intrinsic value, investors could realize significant profits as the market recognizes the true worth of the company.

Growth Prospects:

In addition to the current undervaluation, Financial Institutions Inc presents encouraging growth prospects. As a well-established regional bank, it benefits from a loyal customer base and a strong local presence. Furthermore, Financial Institutions Inc positions itself to leverage the opportunities offered by the evolving financial technologies and the increasing digitization of the banking sector.

Portfolio Diversification:

Investing in Financial Institutions Inc can also contribute to portfolio diversification. By adding shares of a solid regional bank to your portfolio, you reduce your exposure to risks associated with other sectors and can benefit from the advantages inherent in the banking industry.

Conclusion:

Despite the crisis in American regional banks, Financial Institutions Inc stands out as an attractive investment opportunity. Its strong financial position, resilience in the face of market turbulence, and current undervaluation make it a prudent choice for investors seeking undervalued stocks. However, all investments come with risks, so conducting thorough analysis and consulting a financial advisor are essential before making any investment decision. Nevertheless, by taking advantage of the decline in stock price due to the crisis in American regional banks, you could benefit from the growth prospects and advantages offered by Financial Institutions Inc in the banking sector.