In the world of investments, it’s crucial to find lucrative and sustainable opportunities. Today, we will explore why investing in American Tower, one of the largest real estate investment trusts globally, could be an interesting option for investors. With a portfolio of approximately 181,000 communication sites, American Tower is a major player in the shared communications real estate sector. Let’s delve into why this company offers a promising opportunity for investors seeking solid returns and growth.

Exponential growth of 5G:

The demand for 5G connectivity continues to surge globally. With ultra-fast download speeds and minimal latency, 5G opens up new technological possibilities. As a leading owner, operator, and developer of communication real estate, American Tower is well-positioned to benefit from this growth. Its extensive portfolio of communication sites allows it to meet the rising demand for infrastructure required for 5G deployment. By investing in American Tower, investors have the opportunity to capitalize on this major trend and participate in the global connectivity revolution.

International expansion:

American Tower enjoys a widespread global presence, offering opportunities for expansion in various markets. As many countries embark on 5G deployment and seek to enhance their telecommunications infrastructure, the company is well-positioned to seize these opportunities. International expansion provides investors with a chance to diversify their portfolios by investing in a company that benefits from the growth of emerging markets, such as India and other developing countries.

Stable and recurring revenues:

An appealing aspect of investing in American Tower lies in the nature of the company’s revenue generation. Lease contracts with telecommunications operators guarantee regular and stable income. These contracts are typically long-term, providing visibility into future cash flows. Investors can expect recurring revenue from rents paid by operators to utilize American Tower’s communication infrastructure. This financial stability offers a significant advantage for investors seeking solid and predictable returns.

Dividend growth and yield:

In addition to its stable revenue streams, American Tower has a strong track record of consistently increasing dividends. The company has been distributing a growing dividend without interruption for the past 12 years. Currently, the dividend yield stands at approximately 3.38%. This attractive dividend yield provides investors with an additional source of income and the potential for long-term wealth accumulation.

Strong competitive position:

As one of the key players in the shared communications real estate sector, American Tower enjoys a strong competitive position. Its size, experience, and reputation make it an attractive partner for telecommunications operators. This privileged position enables American Tower to maintain its profitability and continue to grow as the demand for telecommunications infrastructure increases.

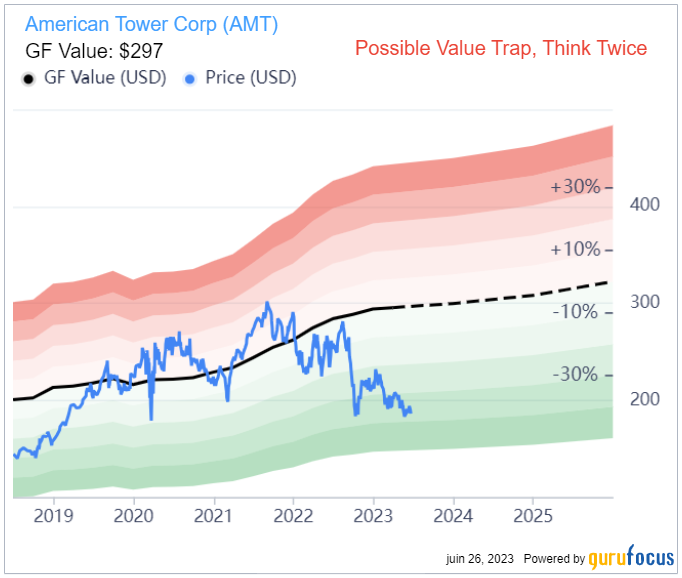

Furthermore, according to Gurufocus analysis, the stock of American Tower appears to be undervalued.

Investing in American Tower presents an appealing opportunity for investors seeking solid and sustainable returns. With the exponential growth of 5G connectivity, international expansion, stable and recurring revenues, a strong competitive position, and a consistent dividend growth history, investors can benefit from this major trend in the telecommunications sector. However, it’s important to conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

https://www.americantower.com/us/solutions/